People perpetrate fraud. People, sometimes just one individual calling all the shots, also run private businesses.

From Bernie Madoff to Kentuckyana Jones to Elizabeth Holmes, fraud is in the news. It is worth a closer look for bankers, other lenders, and investors as to the “how” (and how to ensure you and your financial institution aren’t next). Is there a pattern that professionals can see and avoid?

Let’s test your knowledge and pattern recognition for fraud cases impacting your profession.

Fraud Quiz: What do these lender or investor-related fraud cases have in common?

Theranos: $9 billion fraud with some pretty smart bankers, investors, and board members as victims in this much-hyped Silicon Valley medical device company. Charged with wire fraud and conspiracy to commit wire fraud (against investors, doctors and patients), founder and CEO Elizabeth Holmes’ trial details were recently announced, with jury selection to begin July 28, 2020. The trial will commence in August 2020 in a San Jose federal court and Holmes faces penalties of up to 20 years in prison and millions in fines.

Fast Fact: Theranos never distributed audited financial statements to bankers, investors or anyone else. MarketWatch reported, “…none of the Theranos investors, who invested more than $700 million with Holmes between late 2013 and 2015, had ever requested audited financial statements.”

Olivet University/Newsweek Media Group: Olivet, a San Francisco Bay Area evangelical college, now owns the former Harlem Valley Psychiatric Center in Dover, NY and to secure financing, officials from the school overstated Olivet's financial health to prospective lenders, giving them false financial statements, said New York prosecutors. A bank defrauded in the scheme appealed to a state judge to award them money not payed back in the fraud scheme.

Fast Facts: 1. District Attorney Cyrus Vance, Jr.’s office said school officials created a fictitious auditor to make the university’s false financial statements appear legitimate. 2. The $35 million money laundering scheme’s indictments also involve Newsweek Media Group (also known as IBT Media), Christian Media Corp. and Oikos Networks in the expanded fraud probe.

Canopy Financial: Two top executives of the now-bankrupt Chicago health care transaction software company defrauded investors and customers of more than $93 million. They falsified bank statements to obtain $75 million from private equity firms.

Fast Fact: The execs used a counterfeit auditor’s report (with KPMG’s name and logo) to support the credibility of their falsified documents.

Kentuckyana Jones: Treasure hunting reality TV personality Kentuckyana Jones (aka Michael Barrick) defrauded multiple banks using false financial information over a five-year period before being caught. According to his plea agreement, the schemes identified by prosecutors involved the antiques trader recruiting associates to purchase business property using falsified documents that substantially inflated assets and income to lenders. Whenever a loan was in danger of going into default, he would repeat the process, creating further fake documentation to acquire new loans to pay off previous ones, ultimately exceeding over $1.4 million.

Fast Fact: The case involved five different banks being duped into issuing loans.

Munire Furniture: The CFO for Munire Furniture plead guilty to an $18 million accounting fraud in April 2016. He prepared fraudulent financial statements for the New Jersey-based manufacturer of crib and baby furniture that overstated sales and accounts receivables.

Fast Fact: A commercial bank and a municipality were defrauded into providing loans in this case that was jointly pursued by the United States Attorney for the Southern District of New York, and the Assistant Director-in-Charge of the New York Field Office of the FBI.

Bernard L. Madoff: In this now legendary fraud, the company seemingly had audited financial statements from a CPA firm, and they were distributed to potential investors and other third parties. The SEC charged that the 3-person CPA firm, Friehling & Horowitz, CPAs, P.C., had essentially sold its license to Madoff. Facing a possible 100+ years in prison, David G. Friehling became a cooperating witness in the multi-billion-dollar scheme.

Fast Fact: The accounting firm had been claiming for 15 years that it didn't conduct audits (the highest level of accounting assurance engagement), so they weren’t subject to the rigorous review programs required for CPA firms which do audit work.

The Pattern

OK, so how many of these examples were familiar to you? You can see the pattern is financial statement-related fraud. If you follow the news you also see this type of fraud isn’t all that rare and the victims aren’t just the vulnerable, naïve and eager to trust. They’re educated professionals like you and your colleagues.

In some respects, it’s never been easier or more enticing to commit fraud, because it’s become so simple in the current environment (and the payoff is so big). A recent Association of Certified Fraud Examiners (ACFE) Report called out that, “…while only 19% of total frauds were perpetrated by executives, their median loss of $850,000 per occurrence was more than 17 times greater than the median loss of frauds perpetrated by low-level employees. In addition, 65% of these frauds involved corruption, and 27% were shown to directly involve financial statement fraud. Furthermore, 66% of executive frauds involved collusion, which has been shown throughout various studies to render internal controls ineffective if present.”1

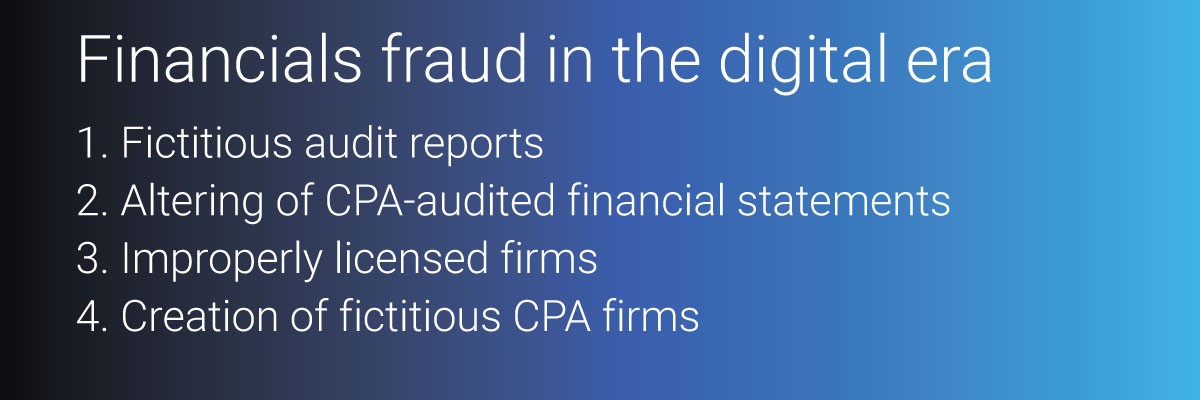

Figure 1: Fraud types driving demand for authenticated, accurate, digital financials for data analytics input, compliance, etc.

The bottom line is that executives and others are perpetrating financial statement-related fraud or, in the case of Theranos, bankers and investors never requested audited financial statements. Some fraudsters get caught eventually and their stories further point out how many tools are now available to defraud banks, other lenders, and investors, which also involves unwanted publicity for lending professionals and investors (and even regulators in some cases).

Why Audited Financial Statements

For private companies, reviewed and audited financial statements communicate to lenders and other stakeholders how the business used its resources to generate profit and expand its business, or how the company incurred loss (and the chances the business succeeds over time).

Risk management and due diligence models and tools (and the professionals that use them) are only as good as their data inputs, and that includes financial statements, optimally audited financial statements from CPA firms authorized to issue audit (and review) reports. Those firms must adhere to a number of stringent professional requirements including, but not limited to, maintaining firm licensure with their state professional requirements. These requirements include maintaining firm licensure with their State Board of Accountancy and where required, participating in a peer review program. These audited financials, prepared by experts, contain the data on which you can count.

The Case for a Private Company Financial Document Clearinghouse

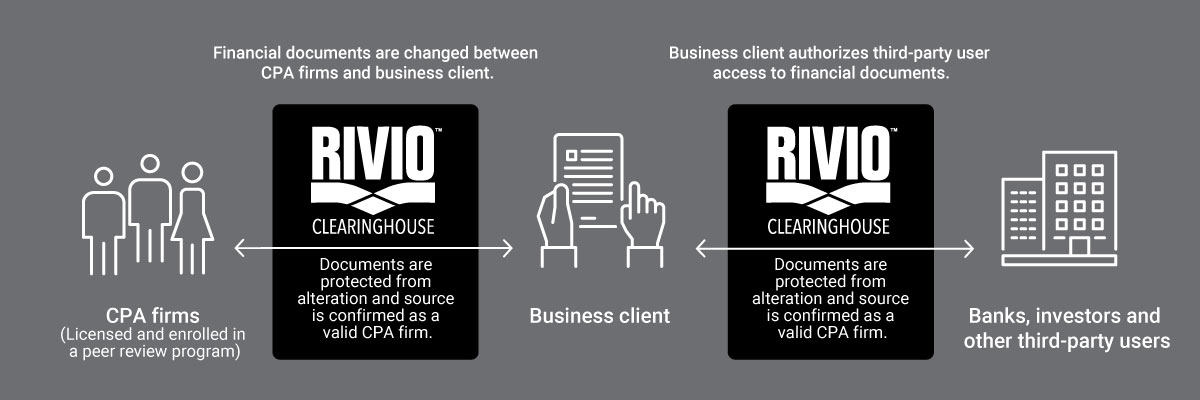

Figure 3: The financial document clearinghouse supports a controlled, one-to-many process for exchanging sensitive financial documents.

Demand for Authenticated Information: The advancement of technology has made it easier to electronically alter information, giving private companies the opportunity to make changes for their financial gain. PDFs and other editable documents that are used to share information can now be easily copied or manipulated.

Digital Transformation of Financial Services: The transformation from manual, paper-based processes to electronic data has impacted many financial services areas, from accounting services, banking and wealth management, to payments and more. Cloud-based platforms have provided new ways to manage financial data and brought real-time access to information.

While the digitization of documents has increased the ease and speed of accessing information, the lack of controls has created more uncertainty about the source and integrity of the data. The vehicles of exchange and communication surrounding this information need to be more sophisticated to address these challenges and must be designed to keep pace with technology advancements. A private company clearinghouse would streamline the flow of financial documents on a digital platform and have built-in protections to prevent fraud. That private company clearinghouse is the RIVIO Clearinghouse.

Figure 2: Financial information exchange in the US public and private company markets

RIVIO Clearinghouse

RIVIO Clearinghouse, developed by CPA.com, in collaboration with Confirmation, was designed to bring heightened efficiency and security to financial document exchange. RIVIO provides a secure platform for valid CPA firms, private businesses, and third-party bakers, etc. to exchange financials that confirms the original source of documents as a valid CPA firm, and ensures information is authentic and unaltered. The online platform offers built-in protections to prevent the use of fraudulent private company audit reports and other types of financial documents, delivering information you and your organization can trust. The source-validation is key for these critical financial data inputs to the risk assessment, due diligence, and other processes and tools used by today’s leading lenders and investors.

The fact that such blatant examples and patterns of fraud have gone undetected shows how susceptible third-party lending institutions can be to financial statement-related fraud, which often has very large (and press-worthy) losses. That’s why a secure online platform for the exchange of private company financial information, is such a vital need for the accounting profession, their business clients and third-party users.

Had the financial institutions or investors required that audited financial statements be submitted through a clearinghouse that verified the documents were provided by a valid CPA firm (and that the documents were authentic and unaltered), none of the perpetrators in the incidents mentioned would have been able to get away with such rampant fraud.

Figure 3: The financial document clearinghouse supports a controlled, one-to-many process for exchanging sensitive financial documents.

To learn more on how RIVIO Clearinghouse can protect bankers and investors, CPA firms, and the entire financial statement eco-system from fraudulent financial document exchange, while also increasing efficiency, visit rivio.com/banker.

Follow @RIVIO_CH on Twitter to stay up to date on important news regarding new fraud cases, fraud prevention tips, and the future of auditing and accounting.